As we come to the end of 2019, put on your party hats, toot your horns and clink your champagne glasses, as we introduce Tower’s MSP Compliance Countdown. The MSP Compliance Countdown provides a quick summary of, in our opinion, the top ten Medicare Secondary Payer compliance stories in 2019. So, start dropping the MSP compliance ball and here we go:

10. Electronic

Payment Option Added to MSPRP – On April 1, 2019, the Centers for

Medicare and Medicaid Services (CMS) added an option to the Medicare Secondary

Payer Recovery Portal (MSPRP) allowing for reimbursement of Medicare

conditional payment demands by direct payment from a checking or savings

account, debit card or PayPal. While

convenient for Medicare beneficiaries, insurer and employer payers say this

does not work with their payment processes. It is our understanding that CMS

may consider expanding this option to other payment methods in 2020.

9. U.S.

Attorney Again Takes on Plaintiffs’ Attorneys for Failure to Reimburse Medicare

– On March 18, 2019, the U.S. Attorney for the District of Maryland announced a

$250,000 settlement agreement with the law firm of Meyers, Rodbell &

Rosenbaum, P.A., as a result of allegations the firm failed to reimburse the

United States for Medicare payments made to medical providers on behalf of a

firm client. This followed a 2018 action

by a U.S. Attorney in Pennsylvania who reached a $28,000 settlement with a

plaintiffs’ firm for failing to reimbursement Medicare. Notably, just last month, the Maryland U.S.

Attorney obtained a $90,000

settlement from a plaintiffs’ firm that had referred the case to

co-counsel.

8. Open Debt

Reports Available in the MSPRP – A 2019 update to the MSPRP provides a

useful tool for insurer and self-insured entities to identify outstanding or

unknown Medicare conditional payment demands.

Called the Open Debt Report, it is available to insurers and

self-insured organizations, or as CMS calls them Responsible Reporting Entities

(RREs), that have registered for MSPRP access (Tower can also access the

reports when it is the Recovery Agent for the RRE).

7. Self-Reporting

Functionality Added to MSPRP – In January, CMS added a self-reporting

function to the MSPRP enabling MSP cases to be reported through the portal

versus via phone or written correspondence to the Benefits Coordination &

Recovery Center (BCRC). Primarily a

time-saving measure, it is a welcome improvement over having to speak to a BCRC

representative who takes down the claim information and enters it into their

system.

6. Update

to CMS WCMSA Reference Guide Clarifies Lyrica Policy – Throughout 2018, CMS

increasingly added Lyrica (brand-name only at the time) to MSAs for diagnoses that

had previously been considered non-Medicare covered. In a January update to its reference guide,

CMS clarified its reasoning for considering Lyrica Medicare-covered for radicular

pain stemming from the spinal cord (cervical, thoracic and lumbar), even when

there is no evidence of what is defined as a “traumatic” spinal cord injury.

5. CMS

Adds Electronic Submission Option for MSA Attestations – On October 7,

2019, CMS released an updated Workers’ Compensation Medicare Set-Aside Portal

(WCMSAP) User Guide which added the capability for both self- and professional-MSA

administrators to electronically submit annual attestations for CMS-approved

MSAs. Previously, the sole option for an MSA administrator was to

complete the attestation form and submit to Medicare’s BCRC via mail. Electronic

submission of annual attestations benefits both CMS and MSA administrators as it

facilitates better and faster coordination of benefits.

4. Proposed

Rules on LMSAs and Section 111 Penalties Again Delayed – The wait continues

for CMS to issue proposed rules on Liability MSAs (LMSAs) and Section 111 Mandatory

Insurer Reporting penalties. CMS’s first

notice in December 2018 indicated the proposed rules would be issued in

September 2019. Subsequent notices moved

the date to October 2019 and we now have notices moving the date for issuing

the proposed rule on penalties to December 2019 (no rule have been released as

of the date this article was published) and for rules on LMSAs to February

2020.

3. Lyrica

Goes Generic – In July 2019, the FDA approved multiple applications for

generic Lyrica. While not directly

related to MSP compliance, this action has a notable impact on MSA allocation

amount given the above-noted use of Lyrica for neuropathic back pain. Lyrica went from $9.36 for a 50 mg pill at

brand name to $0.90 today for the generic, effectively removing it as a

significant cost-driver in the MSA.

2. CMS

Expands MSA Amended Reviews & Modifies Consents to Release in Updated

Reference Guide – In October 2019, CMS released an updated WCMSA Reference

Guide which expanded the Amended Review MSA lookback from four to six years

post the prior MSA approval. It also

introduced some additional language to the Consent to Release form which

requires the claimant to initial that the WCMSA was explained to him or her and

that he or she approves of the contents of the MSA submission. While the expansion of the Amended Review MSA

is welcome news, the revised Consent to Release form, which becomes effective

4/1/2020, may cause delay in the MSA submission process.

1. U.S.

Appellate Court Holds Guaranty Fund Not a Primary Plan under the MSP Act – In

an October 10, 2019 decision from the U.S. Court of Appeals for the Ninth

Circuit, the California Insurance Guarantee Association (CIGA) was found not to

be a primary plan under the Medicare Secondary Payer (MSP) Act. The result of this decision, if not reversed

on appeal, is that CIGA would have no responsibility to reimburse Medicare for

conditional payments or to allocate funds in a Medicare Set-Aside (MSA) for

future medical.

We chose the CIGA decision as #1 in our countdown because it

stands for the principle that we should not readily accept everything CMS says

as gospel. While CMS rightly works to

protect the Medicare trust fund, it should be challenged when it goes beyond

its statutory and regulatory authority or does not even follow its own MSA

review policy.

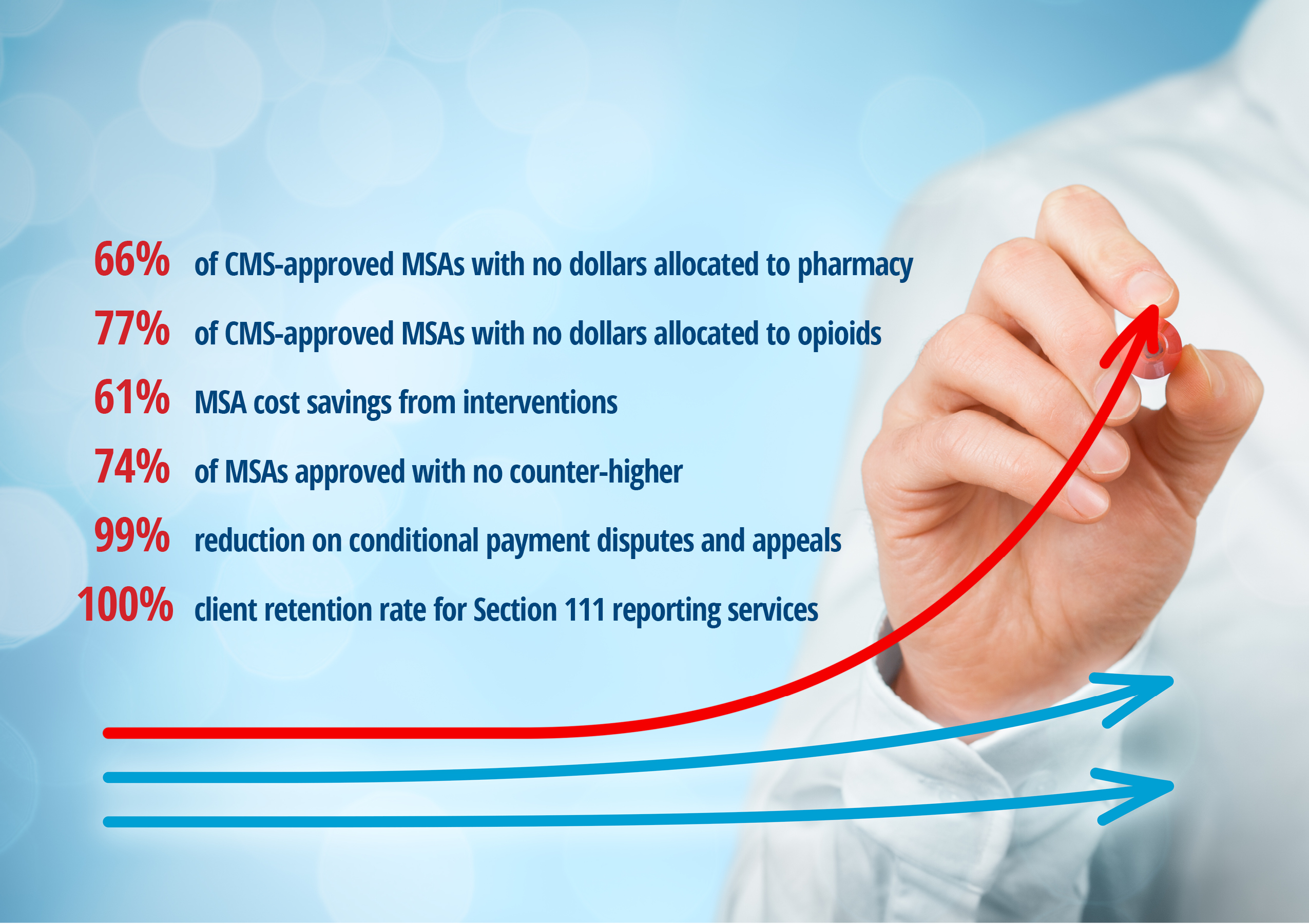

Every day Tower challenges CMS, whether it is the result of

overinclusive Medicare conditional payments or unnecessary or mispriced medical

care allocated in an MSA. Notably, this

year Tower repeatedly challenged CMS’s inclusion of urine drug screens in MSAs

where there was no past history of use.

The result, CMS corrected its policy, saving employers and carriers tens

of thousands of dollars.

If we can leave you with one New Year’s resolution, it is to

not be afraid of challenging CMS, when warranted. Tower will certainly continue to so on your

behalf in 2020.

May you have a warm and wonderful holiday and all the best

in the new year.