We passionately focus on metrics – it’s our driving force in making Tower Measurably Better.

In today’s digital environment, if you are an employer, carrier or TPA, you are likely inundated with data. You get claims data, medical and pharmacy data, predictive analytics, benchmark performance data, claim reports, drug interaction, duplicate therapy and contraindication notices, even drug triggers like poly-pharmacy notices, opioid utilization reports, and morphine equivalent dosage (MED) outliers. You digest voluminous amounts of data internally and also receive a plethora of reports from your vendor partners. With access to so much data, how do you aggregate it into its simplest form, drilling down to the information that actually shows how you’re doing? Whether you call it ‘key performance indicators”(KPIs) or use some other business term, the short answer is “metrics.”

In the words of Peter Drucker, “You can’t manage what you don’t measure.”

As a company that deals with volumes of data internally, and as we work to support our clients’ efforts to comply with the MSP statute, Tower is all about metrics and continuous improvement. Metrics drive internal efficiency improvements, workflow changes to streamline processes and the implementation of technology enhancements to improve our work product and turnaround times. It’s also how we bring added value to clients to optimize MSA outcomes. We define, measure and manage the metrics that yield the ”best” balance in care, cost, and compliance and we use these key performance indicators to reverse engineer MSA preparation methodology to continuously improve MSA, CMS approval and settlement outcomes. We identify the metrics that drive the results we want to see. We then measure our performance and modify processes, workflow, and technology to improve.

METRICS TELL A SIMPLE STORY

Step #1 is to identify what drives the results you seek to achieve. For example, in the case of the MSA and settlement, most would agree that pharmacy is the single biggest cost driver. We’ve heard this from clients through the years and we’ve monitored this issue ourselves. Though prescription drug costs have come down over the past year, pharmacy remains the biggest concern expressed by payers when settling claims that involve an MSA. Yet if asked, would you know what percent of your CMS approved MSAs include opioids, the percent of MSAs that include any pharmacy, or the average cost of prescription drugs on MSAs. You can manage (improve) only what you are measuring.

Measuring 2019 performance in Tower’s total book of business as it relates to CMS approved MSAs and pharmacy costs,

57% of CMS approved MSAs with ongoing medical had $0 allocated for pharmacy;

78% of CMS approved MSAs with ongoing medical had $0 allocated for opioids.

We know what drives the results we want to see and we know where we are today. We’ve measured these metrics for the past 3 years, and continue to monitor to see how we can improve.

ONCE YOU MEASURE, HOW DO YOU MANAGE?

Tower’s clinical staff constantly examines current CMS performance against the latest state workers’ compensation statutes and associated fee schedules, then overlay this with CMS’s review methodology as defined in the most current WCMSA Reference Guide. When changes are found, updates are immediately loaded into our system, verified and released. Getting this process in place took a great deal of time, effort, and technology support, but it was key to our ability to measure performance. Once in place, it’s now a simple verification, audit and sign-off process each month.

In addition to monitoring external changes, our system also benchmarks every CMS response against our internal best practices in MSA allocation. This is done by reconciling every line item in every CMS response. Through this software module, we know exactly how we perform against CMS in pricing, frequency, life expectancy, etc. This information is stored in real time for every response every day, not via a month-end report or only when there’s a Counter Higher response. Our system prompts our staff to review and reconcile each CMS response immediately upon upload.

Through our proactive approach to clinical and pricing methodology and our CMS response measurements, we avoid overfunding when we initially draft the MSA. We are also able to reverse engineer to identify cost drivers and barriers to settlement as part of case triage. We know which clinical and legal interventions can mitigate exposure because we have the historical benchmarks that measure these results historically.

In tracking CMS results over the past 3 years, CMS MSA dollars continue to go down through consistent execution of Tower’s pre-MSA intervention / physician contact process

In 2019, our pre-MSA intervention model yielded CMS approved MSA savings of 53.3% when initiated before CMS submission.

We’ve also identified the documentation/evidence CMS requires in order to approve changes in medical treatment and reductions/discontinuations in drug therapy and we obtain this up front.

With historical benchmarks and CMS performance data, we can easily discern when we have a basis to challenge CMS via re-review submission, and we know what clinical, statutory and pricing documentation to provide to support our request. In measuring our CMS re-review performance for all CMS counter higher responses received in 2019,

Average turnaround time for Re-review determination and submission was <48 hours and CMS Re-review success rate was 68%.

WHAT DOES THIS MEAN TO YOU?

When evaluating MSP partners, check out their numbers. Find out:

- Their success rates for clinical interventions and the average dollars saved because of those interventions;

- The number of Medicare conditional payment searches and investigations initiated and their success rates for disputes and appeals, including total dollars saved;

- How many Medicare Advantage plan searches and investigations they’ve conducted;

- A breakdown of the percentage of CMS MSA approvals, counter-highers and counter-lowers;

- Percentage of counter-highers submitted for re-review and their success rate.

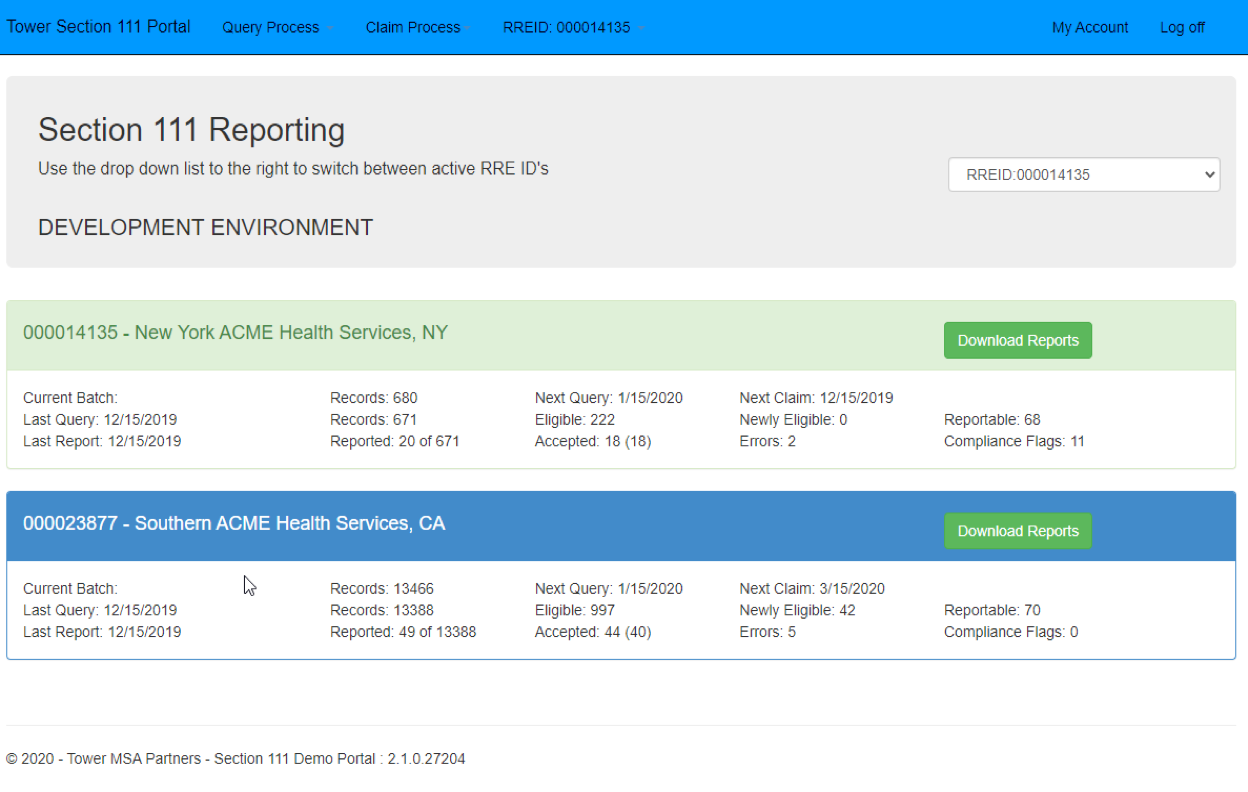

- How they leverage Section 111 data to improve accuracy with conditional payments and MSAs.

COMPLIANCE BY THE BOOK, CLOSURE BY THE NUMBERS

If the above resonates with you, I encourage you to check out our website. We’ve redesigned the site to better reflect our commitment to MSP compliance solutions, not just services. Throughout the site, you’ll see metrics like those above, as well as many other key performance indicators that we use to measure performance, manage improvements and optimize outcomes. You’ll also see specific case studies that demonstrate the successes achieved with MSAs, conditional payment negotiations, physician follow up and clinical interventions, as well as what our clients have to say about working with Tower.

For questions, or to learn more about how Tower is Measurably Better, please email us at info@towermsa.com or call us directly at 888.331.4941.

Related:

Tower CEO Rita Wilson Talks MSAs and Metrics in WorkCompWire’s Leaders Speak